REALPAC partners and collaborates with leading groups in the space, including:

Pillars & Priorities

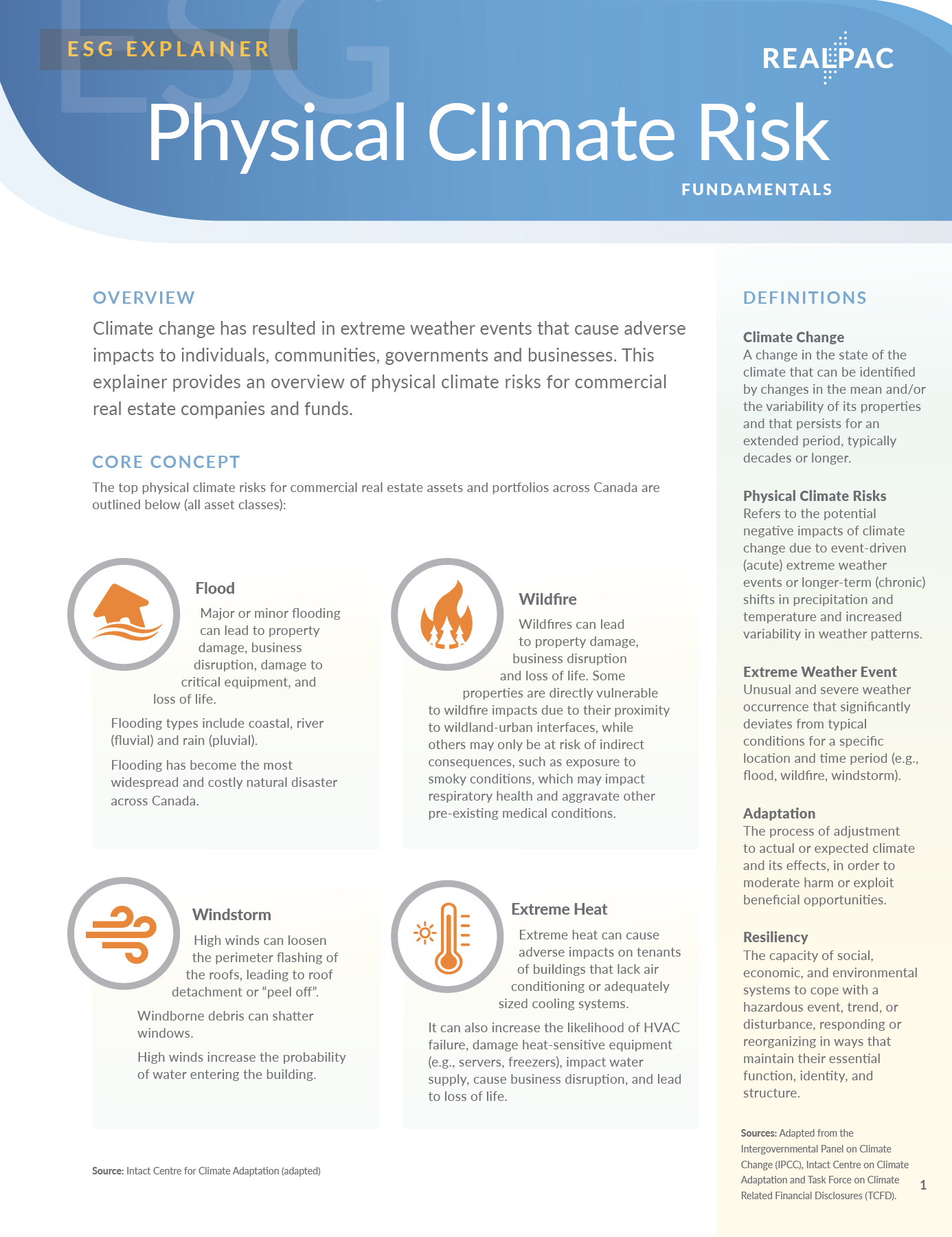

Climate Risk

- Energy & Emissions

- Zero Carbon

- Climate Resilience

Social Impact

- Diversity, Equity & Inclusion

- Affordability

- Sustainable Finance

Sustainability Reporting

- GHG Accounting

- Sustainability Standards & Frameworks

- Mandatory Sustainability Disclosures